(It is, after all, just a model.) But they may also be due to shortcomings of the empirical tests, most notably, poor proxies for the market portfolio of invested wealth, which plays a central role in the model's predictions. The model's empirical problems may reflect true failings. Unfortunately, perhaps because of its simplicity, the empirical record of the model is poor-poor enough to invalidate the way it is used in applications.

#Capital asset pricing model how to#

The attraction of the CAPM is its powerfully simple logic and intuitively pleasing predictions about how to measure risk and about the relation between expected return and risk.

And it is the centerpiece, indeed often the only asset pricing model taught in MBA level investment courses. Four decades later, the CAPM is still widely used in applications, such as estimating the cost of equity capital for firms and evaluating the performance of managed portfolios. Before their breakthrough, there were no asset pricing models built from first principles about the nature of tastes and investment opportunities and with clear testable predictions about risk and return.

Therefore, the correct return from an investment may go lower than what is predicted by the CAPM model.The capital asset pricing model (CAPM) of William Sharpe (1964) and John Lintner (1965) marks the birth of asset pricing theory (resulting in a Nobel Prize for Sharpe in 1990). Therefore, assuming a complete risk-free rate for calculation is not practical. This risk-free rate, however, is highly volatile, changing within a span of just a few days.Ī risk-free rate is not a real factor − Individual investors are unable to lend or borrow at the same rates as the government does. Risk-free rates tend to change frequently − The CAPM considers the short-term government securities to generate a risk-free premium for the rate used in CAPM calculations.

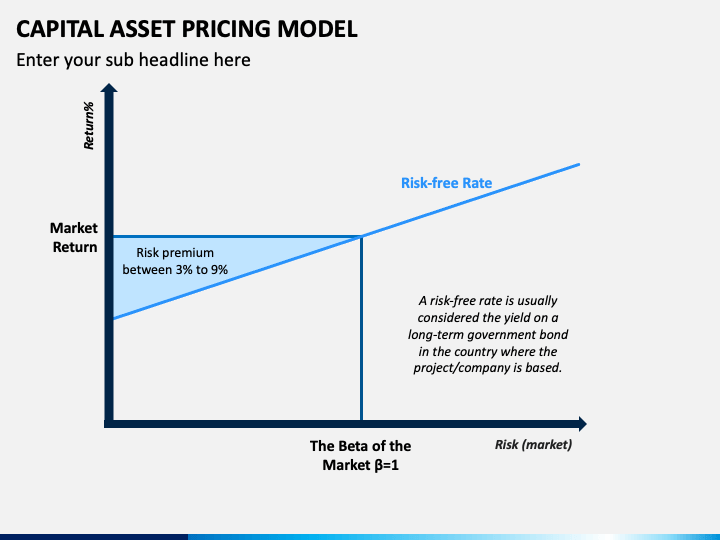

While CAPM is used by investors worldwide, it does have some drawbacks as well. The calculations enable investors to decide one way or the other while it comes to choosing equities. There are certain advantages of the CAPM model of risk-reward evaluation for investors.Īssumption of a diversified portfolio − The CAPM model assumes that an investor always maintains a diversified investment portfolio, which can eliminate the unsystematic risks.Ĭonvenient and simple − This model is built in a way that is extremely easy to use. Lastly, if the risk is more than the established market norm, the ‘Be’ value in the formula will be greater than 1. For the risk that equals the market conditions, the beta will be equal to 1. Therefore, if the risks associated with an investment are lower than the present circumstances, the beta value of the formula will be less than 1. The beta factor here is calculated as a risk along with the current market conditions.

This CAPM formula takes the returns into accounts, which the investor receives due to their risk-taking ability and extended duration of the investment. $$\mathrm)$ = Current market risk premium The unsystematic risks are not taken as threats that are shared by the general market.ĬAPM deals with the systematic risks on securities, therefore predicting what could go wrong with given investments. Unsystematic risks, on the other hand, show the specific dangers associated with investing in a particular stock or equity. For example, inflation rate, Wars, recessions, etc., are systematic risks. Systematic risks are the general dangers, which apply to all forms of investment.

#Capital asset pricing model plus#

It represents the fact that the expected return on an asset is equal to the risk-free return rate plus a premium for taking the risk that is based on the beta of the security.Īssessing the CAPM requires proper knowledge of systematic and unsystematic risks. The Capital Asset Pricing Model (CAPM) describes the association between the anticipated return and the risks of investing in a security.

0 kommentar(er)

0 kommentar(er)